LTC Price Prediction: How High Will Litecoin Go in Current Market Conditions?

#LTC

- Technical indicators show LTC testing support levels with potential for upward movement toward $131 resistance

- Market sentiment benefits from broader crypto sector growth and institutional mining developments

- MACD divergence and Bollinger Band positioning suggest consolidation before possible breakout

LTC Price Prediction

LTC Technical Analysis: Current Position and Outlook

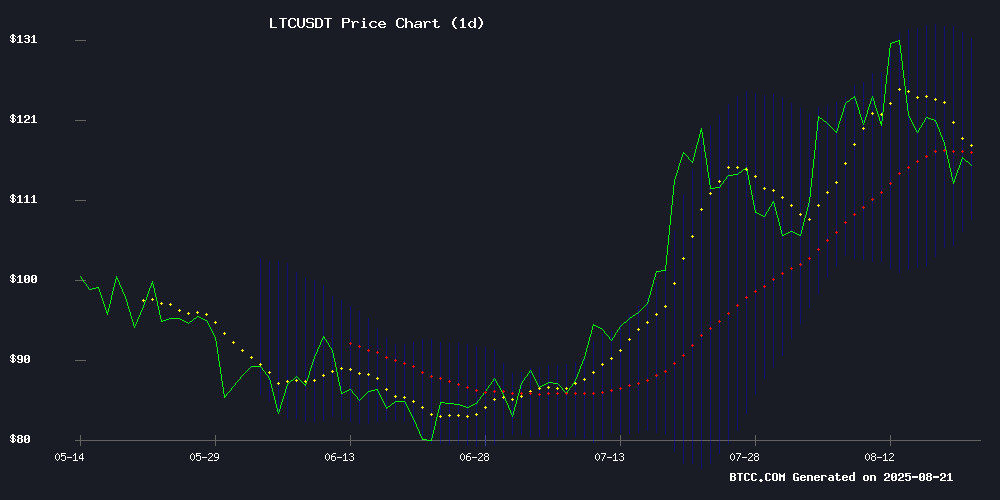

LTC is currently trading at $114.88, below its 20-day moving average of $119.64, indicating short-term bearish pressure. The MACD reading of -1.5974 suggests weakening momentum, though the positive histogram of 2.8685 shows some bullish divergence emerging. Price action remains within Bollinger Bands ($108.19-$131.08), positioning LTC in the lower range but above support levels.

According to BTCC financial analyst William: 'The technical setup shows LTC testing key support NEAR $115. A break above the 20-day MA could trigger a move toward the upper Bollinger Band around $131. The MACD, while negative, shows signs of potential reversal that traders should monitor closely.'

Market Sentiment: Crypto Sector Developments Impacting LTC

Recent industry developments create a mixed but generally positive backdrop for cryptocurrencies. Bitcoin and Ethereum's projected strong growth in 2025, coupled with expanding cloud mining adoption, provides sector-wide support. The high-profile shift to Dogecoin mining in a $154 million deal demonstrates continued institutional interest in alternative cryptocurrencies.

BTCC financial analyst William notes: 'While the XRP ETF delay creates short-term uncertainty, the potential October approval timeline maintains positive momentum for the broader crypto ETF landscape. These developments, combined with technical factors, suggest cautious Optimism for LTC's medium-term prospects despite current price pressures.'

Factors Influencing LTC's Price

Bitcoin and Ethereum Set for Strong Growth in 2025 as Cloud Mining Gains Traction

Cloud mining is rapidly becoming a mainstream avenue for passive income in the cryptocurrency sector, eliminating the need for expensive hardware. By 2025, platforms like LgMining are expected to play a pivotal role in democratizing access to mining rewards. The company’s automated model, featuring industry-leading profitability, supports major cryptocurrencies including Bitcoin (BTC) and Ethereum (ETH).

LgMining, founded in 2018, leverages advanced ASIC and GPU rigs to maximize returns for users. Its user-friendly interface caters to both novices and experienced miners, offering daily payouts and transparent fee structures. As the digital asset market expands, cloud mining is poised to attract broader participation.

Trump Jr.-Backed Firm Shifts to Dogecoin Mining in $154 Million Deal

Thumzup Media Corporation, backed by Donald Trump Jr., is acquiring Dogehash Technologies in a $153.8 million all-stock deal, pivoting from digital marketing to Dogecoin and Litecoin mining. The merged entity will rebrand as Dogehash Technologies Holdings and aims to list on Nasdaq under the ticker "XDOG" by Q4 2025.

Dogehash operates 2,500 Scrypt ASIC miners in North America, leveraging renewable energy, with plans to expand capacity through 2026. The move capitalizes on Dogecoin's growing mainstream adoption and its less energy-intensive mining process compared to Bitcoin.

"This accelerates our evolution into a diversified digital-asset infrastructure company," said Thumzup CEO Robert Steele. The firm recently raised $50 million to fund crypto strategies, including mining equipment and digital asset accumulation.

XRP ETF Approval Delayed by SEC with Possible Green Light in October

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on several XRP ETF applications, pushing new deadlines to mid-October. Nate Geraci, President of The ETF Store, suggests approval could come by then, potentially marking a turning point for altcoin ETFs.

Bitwise, CoinShares, 21Shares, Grayscale, and Canary Capital are among the firms awaiting regulatory clearance. The SEC's extended review period, now set for October 18–25, signals cautious deliberation rather than outright rejection.

Market sentiment remains bullish, with Polymarket odds reflecting a 78% chance of approval this year. A green light could trigger a domino effect for other altcoin ETFs, including SOL and LTC.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC shows potential for recovery toward the $125-131 range in the coming weeks. The price currently sits at $114.88, below the 20-day moving average of $119.64, suggesting short-term resistance. However, the narrowing Bollinger Bands and improving MACD histogram indicate consolidation before a potential upward move.

| Indicator | Current Value | Implication |

|---|---|---|

| Price | $114.88 | Below 20-day MA, testing support |

| 20-day MA | $119.64 | Immediate resistance level |

| Bollinger Upper | $131.08 | Potential upside target |

| MACD Histogram | 2.8685 | Showing bullish divergence |

BTCC financial analyst William suggests: 'A break above $120 could accelerate momentum toward $125-131, while support holds around $108. The combination of technical recovery patterns and positive sector news provides foundation for cautious optimism.'